Diamondback Energy (FANG), which describes itself as a “must own Permian Basin pure-play,” could raise its dividend on Feb. 24, when it is set to release earnings. If it hikes what it calls the “base dividend” on that date, FANG stock could move higher. However, this article will show that shorting out-of-the-money put options might be a better play.

FANG closed Friday, January 23, at $154.02, still below its recent peak of $160.28 on Dec. 10, 2025. But it is still up from a recent low of $140.45 on Jan. 7, 2026.

Why Its Dividend Could Rise, Despite Headwinds

FANG stock now has an annual dividend yield of 2.60% ($4.00/$154.02). Last year, its average yield was 2.66% according to Morningstar, and 2.63% according to Yahoo! Finance.

So, it's not undervalued on a historical basis.

Moreover, Diamondback Energy recently reported lower average oil prices for the last three months. On Jan. 12, a Form 8-K reported that its Q4 realized oil prices were $58.00 per barrel, down from $64.60 in Q3. This was also similar to average hedged oil prices: $57.07 in Q4 vs. $63.70. In addition, its hedged gas price fell from $1.75 per Mcf to $1.03 in Q4.

As a result, investors might expect that the company's cash flow could be lower, depending on its capex spending, which is highly flexible, as well as its acquisition/disposal plans.

Nonetheless, Diamondback has a 7-year history of raising its dividend per share annually, according to Seeking Alpha.

Moreover, management made clear in its last shareholder letter, where it anticipated lower cash flow, that it prioritizes shareholder returns over capex spending. It may be willing to adjust its share buyback plans as well.

Where This Leaves FANG Stock

It seems reasonable, as a result, to expect a slightly higher dividend per share, say a 5% hike to $4.20, or $1.05 per quarter.

That would give FANG stock a forward yield of 2.73% (i.e., $4.20/$154.02 = 0.02727).

So, if FANG stock yields between 2.60% and 2.63% over the coming year, FANG stock could rise to between $159.70 and $161.54, or $160.62 on average:

$4.20/0.0263 = $159.70

$4.20/0.0260 = $161.54

Average Price Target: $160.62

That is +4.23% higher.

However, with a $4.30 annual dividend, FANG could average between $163.50 and $165.39, or $164.45 per share. That's +6.77% higher than Friday's close.

The bottom line is that investors might be able expect a rise in FANG stock.

However, there's no guarantee. But one way to make an immediate monthly yield is to sell short 1-month out-of-the-money put options.

Shorting FANG OTM Puts

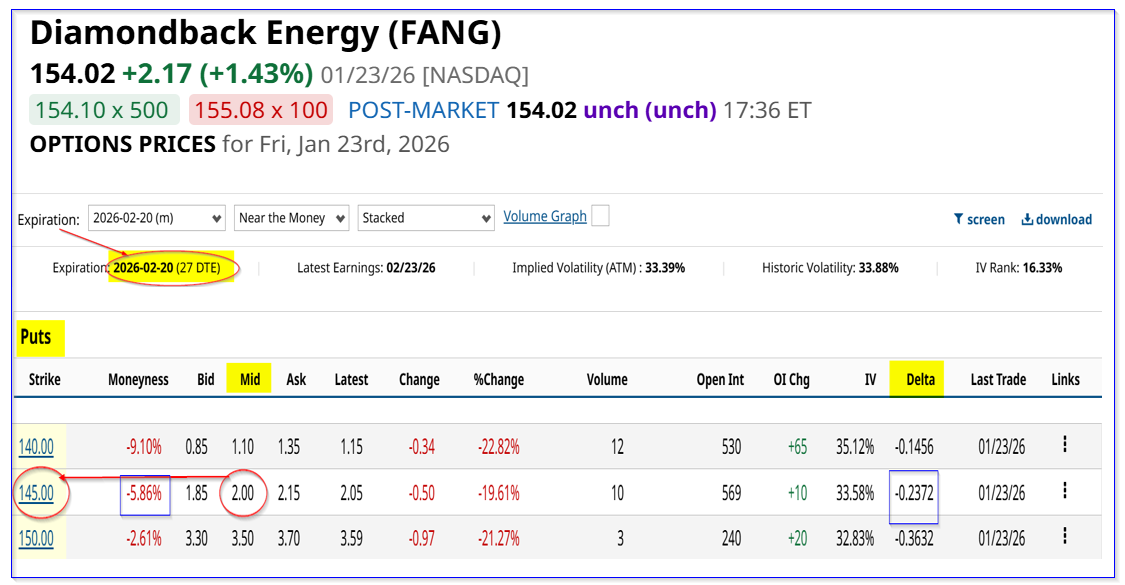

For example, look at the Feb. 20, 2026, expiry period for FANG put options. It shows that the $145.00 put option strike price has a midpoint premium of $2.00. This provides a short-seller a one-month yield of 1.379% (i.e., $2.00/$145.00).

An investor who secures $14,500 can immediately receive $200 in their account by entering an order to “Sell to Open” a put contract at the $145.00 strike expiring Feb. 20.

As a result, the $200 income provides the investor a one-month cash-secured short-put yield of 1.379% ($200/$14,500).

Downside Risks and How to Handle Them

The worst that can happen doing this is that the investor's account could be assigned to buy 100 shares (with the collateral) at $145.00. That happens if FANG falls 5.86% to $145 in the next 27 days.

That could potentially result in an unrealized loss, if, for example, FANG falls below $145.00.

But, not to worry. First, the breakeven (BE) point is lower, since the account has already received the income:

$145.00 - $2.00 = $143.00 breakeven (BE)

That BE price is over $11.00 lower than Friday's close, or -7.15% below $154.02. That provides good downside protection.

Moreover, the investor could end up with a higher annual yield if that happens (i.e., $4.20/$143.00, or 2.94%, almost 3.0%). This would mean just holding the assigned FANG shares.

In addition, the investor could repeat this short-put play each month. That could mitigate any potential unrealized loss from having the put position assigned.

For example, if the investor can make $200 each month for a quarter, or $600, the expected return is 4.13% ($600/$14,500). However, there is no guarantee that the short-put yield will stay at this level.

Nevertheless, this is a great way to make a good return instead of just buying FANG and hoping for a dividend increase.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart