Looking back on healthcare providers & services stocks’ Q3 earnings, we examine this quarter’s best and worst performers, including Cardinal Health (NYSE:CAH) and its peers.

The healthcare providers and services sector, from insurers to hospitals, benefits from consistent demand, generating stable revenue through premiums and patient services. However, it faces challenges from high operational and labor costs, reimbursement pressures that squeeze margins, and regulatory uncertainty. Looking ahead, an aging population with more chronic diseases and a shift toward value-based care create tailwinds. Digitization via telehealth, data analytics, and personalized medicine offers new revenue streams. Nonetheless, headwinds persist, including clinical labor shortages, ongoing reimbursement cuts, and regulatory scrutiny over pricing and quality.

The 40 healthcare providers & services stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was 0.6% below.

In light of this news, share prices of the companies have held steady as they are up 1.8% on average since the latest earnings results.

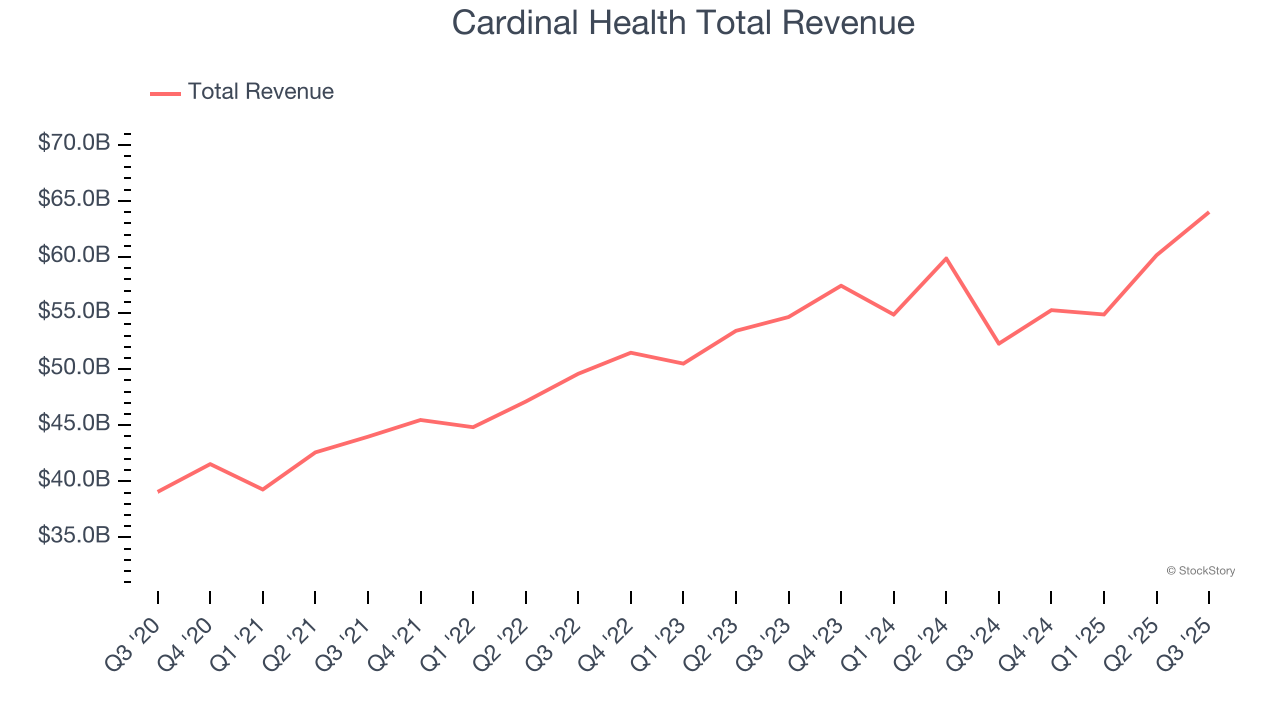

Cardinal Health (NYSE:CAH)

Operating as a critical link in the healthcare supply chain since 1979, Cardinal Health (NYSE:CAH) distributes pharmaceuticals and manufactures medical products for hospitals, pharmacies, and healthcare providers across the global healthcare supply chain.

Cardinal Health reported revenues of $64.01 billion, up 22.4% year on year. This print exceeded analysts’ expectations by 7.8%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ revenue estimates and a beat of analysts’ EPS estimates.

"We are pleased with our strong broad-based operational and financial performance to begin fiscal 2026," said Jason Hollar, CEO of Cardinal Health.

Interestingly, the stock is up 20.7% since reporting and currently trades at $198.49.

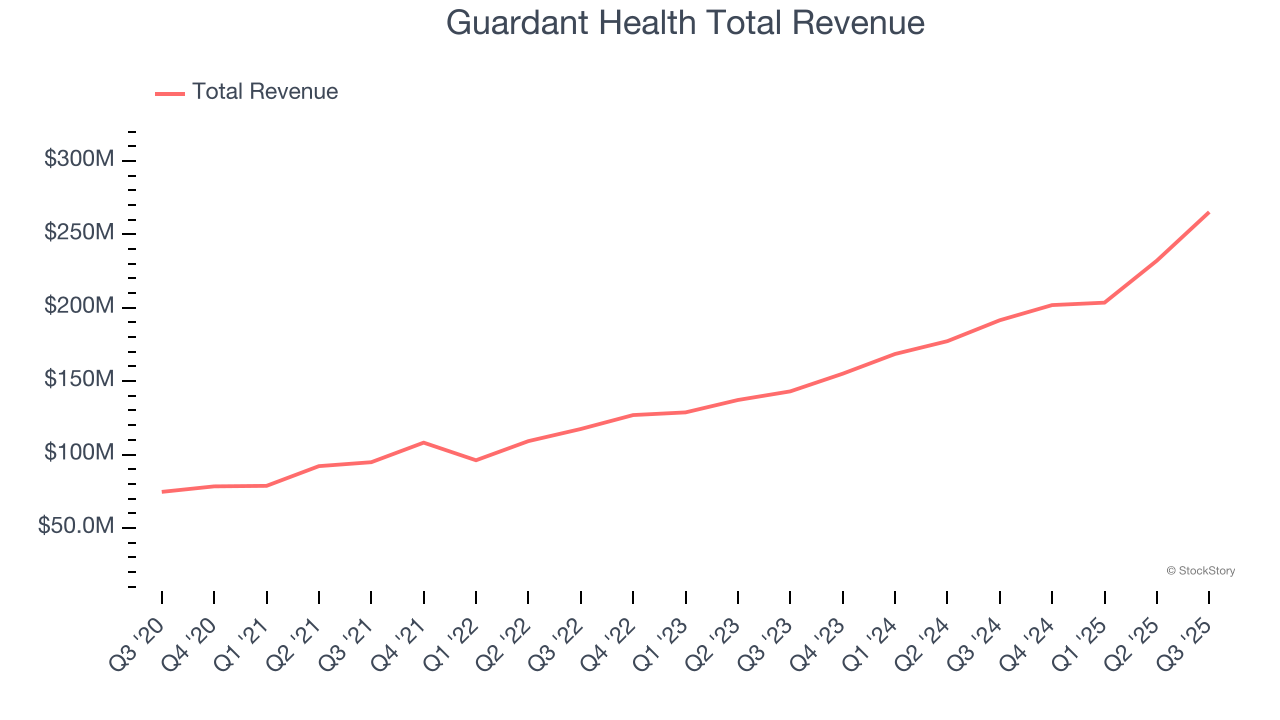

Best Q3: Guardant Health (NASDAQ:GH)

Pioneering the field of "liquid biopsy" with technology that can identify cancer-specific genetic mutations from a simple blood draw, Guardant Health (NASDAQ:GH) develops blood tests that detect and monitor cancer by analyzing tumor DNA in the bloodstream, helping doctors make treatment decisions without invasive biopsies.

Guardant Health reported revenues of $265.2 million, up 38.5% year on year, outperforming analysts’ expectations by 12.6%. The business had an incredible quarter with an impressive beat of analysts’ revenue estimates and full-year revenue guidance exceeding analysts’ expectations.

Guardant Health scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 33.8% since reporting. It currently trades at $96.69.

Is now the time to buy Guardant Health? Access our full analysis of the earnings results here, it’s free for active Edge members.

Slowest Q3: Brookdale (NYSE:BKD)

With a network of over 650 communities serving approximately 59,000 residents across 41 states, Brookdale Senior Living (NYSE:BKD) operates senior living communities across the United States, offering independent living, assisted living, memory care, and continuing care retirement communities.

Brookdale reported revenues of $813.2 million, up 3.7% year on year, falling short of analysts’ expectations by 1.7%. It was a softer quarter as it posted a significant miss of analysts’ EPS estimates and a miss of analysts’ revenue estimates.

Interestingly, the stock is up 15.9% since the results and currently trades at $10.56.

Read our full analysis of Brookdale’s results here.

Pediatrix Medical Group (NYSE:MD)

With a network of approximately 2,620 affiliated physicians caring for some of the most vulnerable patients, Pediatrix Medical Group (NYSE:MD) provides specialized physician services focused on neonatal, maternal-fetal, pediatric cardiology and other pediatric subspecialty care across 37 states.

Pediatrix Medical Group reported revenues of $492.9 million, down 3.6% year on year. This result surpassed analysts’ expectations by 3.2%. Overall, it was a stunning quarter as it also produced an impressive beat of analysts’ same-store sales estimates and a beat of analysts’ EPS estimates.

The stock is up 32.9% since reporting and currently trades at $22.56.

Read our full, actionable report on Pediatrix Medical Group here, it’s free for active Edge members.

UnitedHealth (NYSE:UNH)

With over 100 million people served across its various businesses and a workforce of more than 400,000, UnitedHealth Group (NYSE:UNH) operates a health insurance business and Optum, a healthcare services division that provides everything from pharmacy benefits to primary care.

UnitedHealth reported revenues of $113.2 billion, up 12.2% year on year. This print met analysts’ expectations. Taking a step back, it was a mixed quarter as it also logged a narrow beat of analysts’ customer base estimates but revenue in line with analysts’ estimates.

The company kept the number of customers flat at a total of 54.08 million. The stock is down 9.6% since reporting and currently trades at $330.25.

Read our full, actionable report on UnitedHealth here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.