Over the past six months, Payoneer’s shares (currently trading at $5.65) have posted a disappointing 19.1% loss, well below the S&P 500’s 14.3% gain. This may have investors wondering how to approach the situation.

Following the pullback, is this a buying opportunity for PAYO? Find out in our full research report, it’s free for active Edge members.

Why Is PAYO a Good Business?

Founded during the early days of global e-commerce in 2005 to solve international payment challenges, Payoneer (NASDAQ:PAYO) provides financial technology services that enable small and medium-sized businesses to send and receive payments globally across borders.

1. Skyrocketing Revenue Shows Strong Momentum

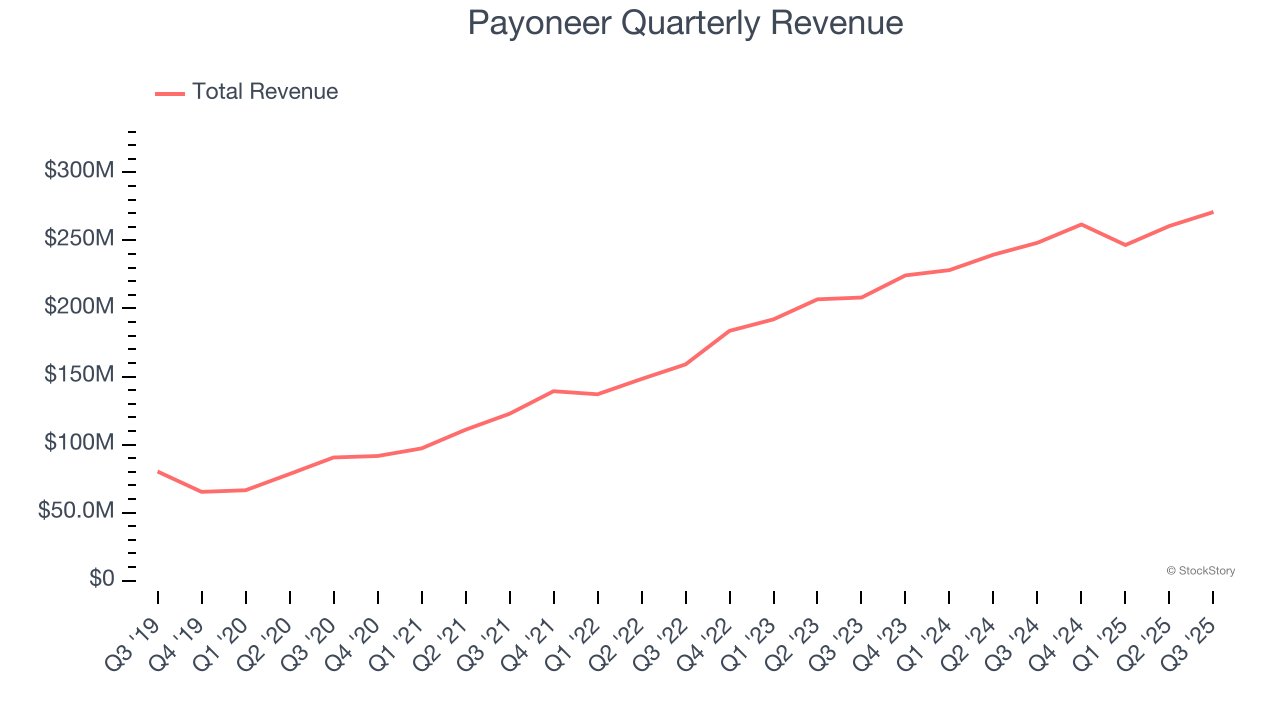

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years.

Over the last five years, Payoneer grew its revenue at an incredible 28.2% compounded annual growth rate. Its growth beat the average financials company and shows its offerings resonate with customers.

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Payoneer’s full-year EPS flipped from negative to positive over the last four years. This is a good sign and shows it’s at an inflection point.

Final Judgment

These are just a few reasons Payoneer is a rock-solid business worth owning. With the recent decline, the stock trades at 19.8× forward P/E (or $5.65 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free for active Edge members.

Stocks We Like Even More Than Payoneer

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.