Granite Construction currently trades at $76.70 per share and has shown little upside over the past six months, posting a small loss of 4.5%.

Given the underwhelming price action, is now a good time to buy GVA? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free.

Why Does Granite Construction Spark Debate?

Having played a role in the construction of the Hoover Dam, Granite Construction (NYSE:GVA) is a provider of infrastructure solutions for roads, bridges, and other projects.

Two Positive Attributes:

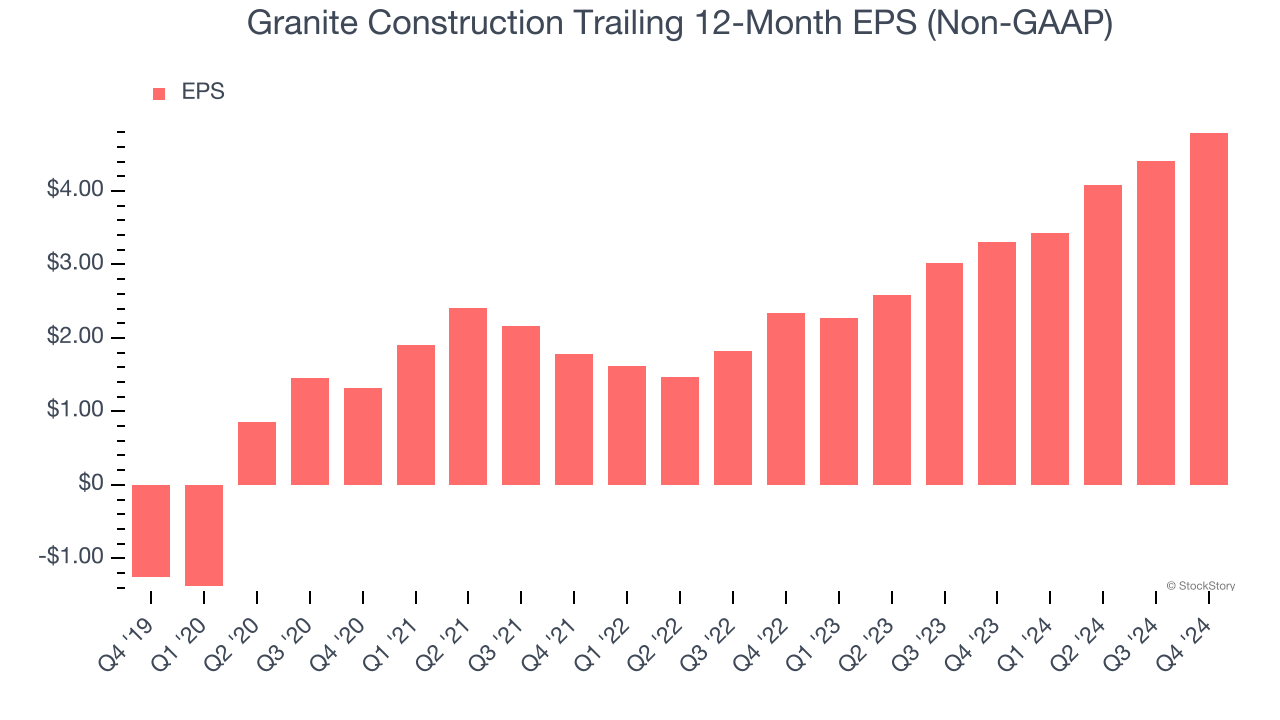

1. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Granite Construction’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

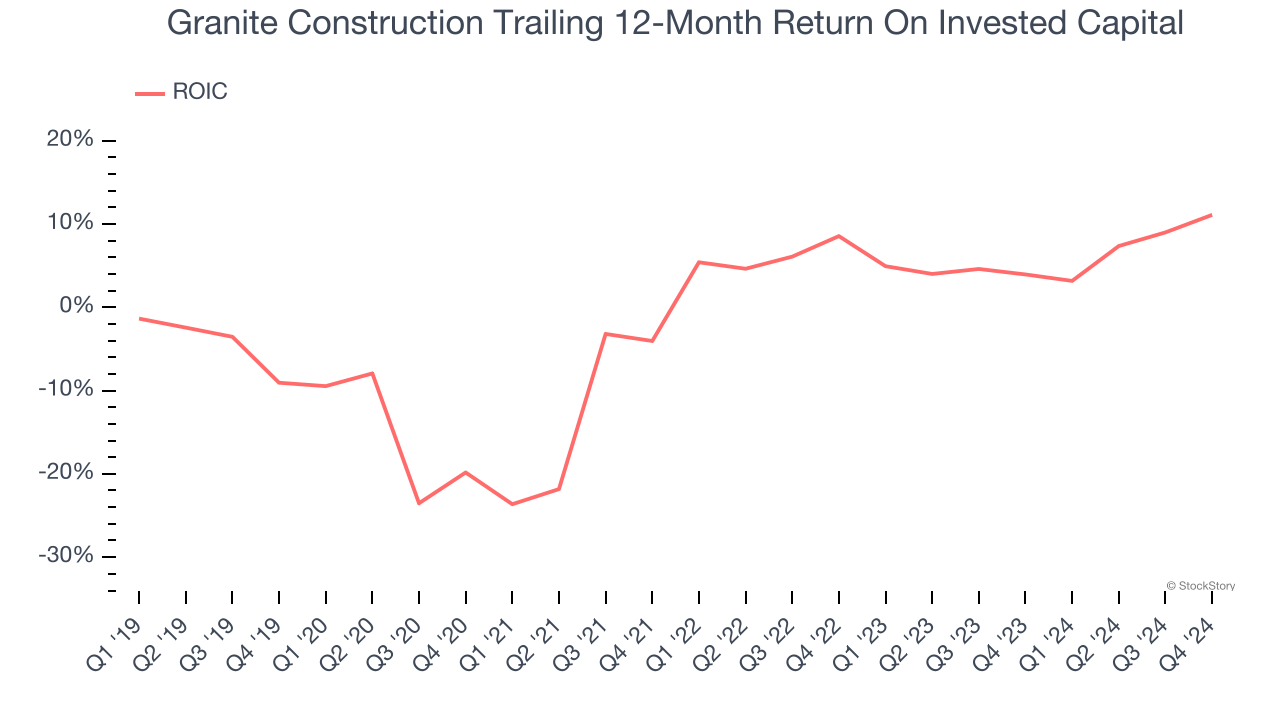

2. New Investments Bear Fruit as ROIC Jumps

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Granite Construction’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

One Reason to be Careful:

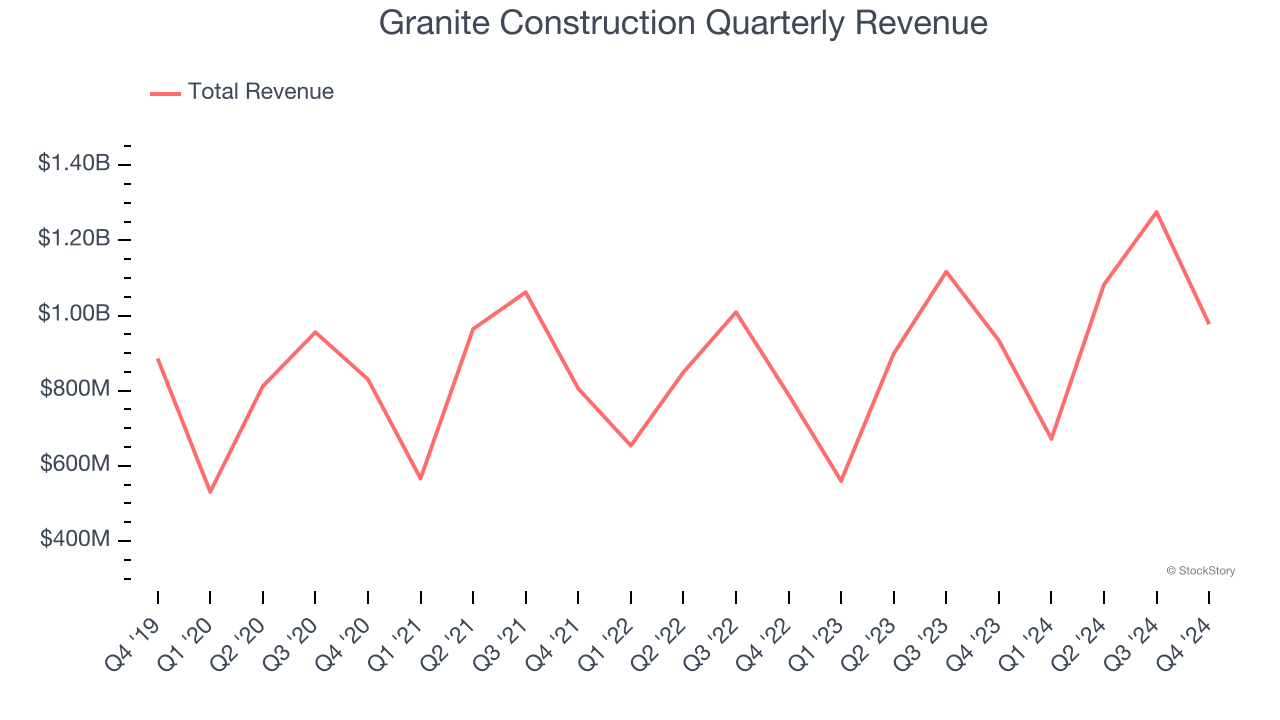

Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Granite Construction’s 3.1% annualized revenue growth over the last five years was sluggish. This wasn’t a great result compared to the rest of the industrials sector, but there are still things to like about Granite Construction.

Final Judgment

Granite Construction’s merits more than compensate for its flaws, but at $76.70 per share (or 14× forward price-to-earnings), is now the time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Granite Construction

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.