Recent Articles from MarketMinute

MarketMinute is a dynamic online platform dedicated to delivering real-time stock news and market insights to investors and enthusiasts alike. Operated by FinancialContent, a leading digital publisher in financial news, the website offers up-to-the-minute updates on stock movements, corporate earnings, analyst ratings, and macroeconomic trends that shape the financial landscape.

Website: https://www.marketminute.com

On January 27, 2026, Boeing (NYSE: BA) released its fourth-quarter and full-year 2025 financial results, marking what many analysts are calling a "credibility reset" for the storied aerospace giant. For the first time since 2018, the company reported a positive annual net income, signaling an end to the multi-year spiral

Via MarketMinute · January 30, 2026

The Platinum Moat: American Express Projects Record 2026 Profits as High-End Spending Defies Economic Gravity

On January 30, 2026, American Express (NYSE:AXP) delivered a powerful signal of confidence to the financial markets, issuing a robust 2026 profit forecast that comfortably exceeded Wall Street’s expectations. Despite a minor earnings-per-share

Via MarketMinute · January 30, 2026

AUSTIN, TX — In a move that could redefine the global technology and aerospace landscape, reports have surfaced that Elon Musk is considering a massive corporate consolidation, potentially merging the private aerospace giant SpaceX with either Tesla (NASDAQ: TSLA) or his rapidly growing AI startup, xAI. The rumors, which reached a

Via MarketMinute · January 30, 2026

As the final trading day of January 2026 draws to a close, North American markets are grappling with a renewed surge in trade-related volatility. On January 30, 2026, shares of Bombardier Inc. (TSX: BBD.B) plunged by over 7% following a direct broadside from the White House, marking a sharp

Via MarketMinute · January 30, 2026

The appliance giant Whirlpool Corporation (NYSE:WHR) saw its shares plummet by 10% on January 30, 2026, following a fourth-quarter earnings report that missed analyst expectations on nearly every key metric. The steep decline reflects growing investor anxiety over a "challenging" consumer environment defined by stubbornly high mortgage rates and

Via MarketMinute · January 30, 2026

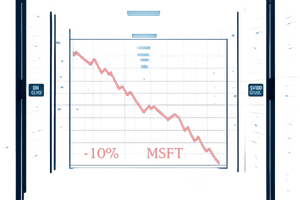

In a jarring disconnect between fiscal performance and market sentiment, ServiceNow (NYSE: NOW) saw its shares crater by nearly 10% on January 29, 2026, despite delivering a Fourth Quarter 2025 report that exceeded analyst expectations on every major metric. The enterprise software giant, long considered a bellwether for the digital

Via MarketMinute · January 30, 2026

Mastercard Incorporated (NYSE: MA) reported a significant earnings beat for the fourth quarter of 2025, sending its stock price climbing over 2% in early trading on January 30, 2026. The financial services giant outperformed Wall Street expectations on both the top and bottom lines, fueled by a sustained resilience in

Via MarketMinute · January 30, 2026

SAN FRANCISCO — In a financial climate marked by fluctuating consumer sentiment and persistent inflationary pressures, payments giant Visa Inc. (NYSE: V) has once again demonstrated its role as a cornerstone of the global economy. Reporting its fiscal first-quarter 2026 results on January 29, the company posted better-than-expected revenue and earnings,

Via MarketMinute · January 30, 2026

International Business Machines (NYSE: IBM) has stunned Wall Street with a powerhouse fourth-quarter earnings report that sent its stock price soaring by more than 10% in the days following the release. As of January 30, 2026, the tech giant’s shares have reached multi-year highs, trading near the $315 mark—

Via MarketMinute · January 30, 2026

DALLAS — Shares of Southwest Airlines (NYSE: LUV) surged 5% in early trading following the company’s release of its fourth-quarter 2025 financial results and an unexpectedly aggressive profit forecast for 2026. The Dallas-based carrier, which has spent the last year undergoing the most radical transformation in its 53-year history, told

Via MarketMinute · January 30, 2026

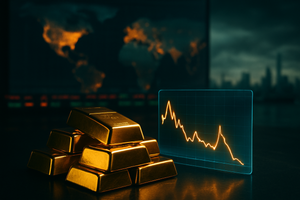

NEW YORK – In a week that will likely be remembered as one of the most volatile in the history of commodities trading, precious metals have undergone a violent "flash correction" that has left investors reeling. After a parabolic ascent that saw Gold shatter the $5,500 per ounce ceiling and

Via MarketMinute · January 30, 2026

In a year marked by a significant "lower for longer" pricing environment and shifting global energy dynamics, Chevron Corporation (NYSE: CVX) reported a resilient fourth-quarter 2025 performance that exceeded analyst expectations on the bottom line. Despite facing a sharp decline in average Brent crude prices—averaging $69 per barrel in

Via MarketMinute · January 30, 2026

IRVING, TX — In a display of operational muscle that has become the hallmark of its post-merger era, Exxon Mobil Corporation (NYSE:XOM) reported fourth-quarter 2025 earnings today that comfortably cleared Wall Street’s hurdles. Despite a challenging environment characterized by a nearly 20% year-over-year slide in global crude prices and

Via MarketMinute · January 30, 2026

Reports surfaced this week that Amazon.com, Inc. (NASDAQ:AMZN) is in advanced negotiations to invest a staggering $50 billion into OpenAI, the world’s leading artificial intelligence laboratory. This potential deal, first reported by major financial outlets on January 29, 2026, marks a seismic shift in the "AI Arms

Via MarketMinute · January 30, 2026

In a week that many analysts are calling a "watershed moment" for the future of transportation and artificial intelligence, Tesla (NASDAQ:TSLA) reported fourth-quarter 2025 earnings that defied the grim expectations of the "EV winter." On January 28, 2026, the company posted a non-GAAP earnings per share (EPS) of $0.

Via MarketMinute · January 30, 2026

In a jarring reminder that even the world’s most valuable companies are not immune to the gravity of market expectations, Microsoft Corp. (NASDAQ:MSFT) saw its shares plunge nearly 10% following its Q2 FY2026 earnings report on January 28, 2026. Despite beating top and bottom-line estimates with total revenue

Via MarketMinute · January 30, 2026

MENLO PARK, CA — In a resounding validation of its aggressive pivot toward artificial intelligence, Meta Platforms (NASDAQ:META) saw its stock price skyrocket by 9% in late January 2026. The surge followed a blowout fourth-quarter earnings report that silenced critics of the company’s massive capital expenditure and established the

Via MarketMinute · January 30, 2026

Apple Inc. (NASDAQ: AAPL) delivered a commanding performance in its fiscal first-quarter earnings report on January 29, 2026, shattering revenue and profit records on the back of explosive demand for the iPhone 17. Despite exceeding analyst expectations across nearly every major metric, the tech giant saw its stock price decline

Via MarketMinute · January 30, 2026

The financial markets were jolted on January 30, 2026, as the Bureau of Labor Statistics (BLS) released Producer Price Index (PPI) data for December 2025 that was significantly "warmer" than any analyst had predicted. Headline PPI rose 0.5% month-over-month, more than double the consensus estimate of 0.2%, while

Via MarketMinute · January 30, 2026

In a move that sent immediate shockwaves through global financial markets, President Donald Trump officially nominated former Federal Reserve Governor Kevin Warsh to succeed Jerome Powell as the Chair of the Federal Reserve. The announcement, made on the morning of January 30, 2026, represents a fundamental shift in the leadership

Via MarketMinute · January 30, 2026

Following a turbulent period of political gridlock and fiscal uncertainty, new data released by the U.S. Census Bureau on January 21, 2026, reveals that U.S. construction spending rose by 0.5% in October 2025. This increase brought the seasonally adjusted annual rate to $2.175 trillion, a figure

Via MarketMinute · January 30, 2026

The Conference Board’s Leading Economic Index (LEI) recorded a 0.3% slip in its latest reading, signaling a cooling trajectory for the United States economy as it enters the new year. This downturn, reported in January 2026, marks a pivotal moment for markets that have been grappling with the

Via MarketMinute · January 30, 2026

The American consumer is beginning to see a light at the end of the inflationary tunnel. According to the final January 2026 reading from the University of Michigan Survey of Consumers, one-year inflation expectations have eased to 4.0%, down from 4.2% in December and a peak earlier in

Via MarketMinute · January 30, 2026

In a decisive move to reassure investors and capitalize on what it perceives as an undervalued stock price, Experian PLC (LSE: EXPN) announced a massive $1 billion share buyback program on January 30, 2026. The program, which commenced immediately upon announcement, is designed to reduce the company's ordinary share capital

Via MarketMinute · January 30, 2026

In a month characterized by high-stakes brinkmanship and a dramatic reshuffling of global energy maps, West Texas Intermediate (WTI) crude oil has found a precarious footing, stabilizing at the $65 per barrel threshold as of late January 2026. This stabilization comes after a volatile 15% rally throughout the month, a

Via MarketMinute · January 30, 2026

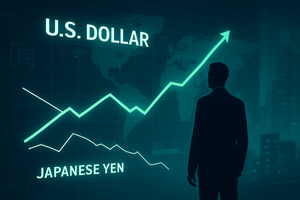

WASHINGTON D.C. — The global currency markets have been sent into a whirlwind this week as the U.S. Dollar staged a powerful recovery against the Japanese Yen. The surge followed definitive comments from U.S. Treasury Secretary Scott Bessent, who effectively shut the door on rumors of a coordinated

Via MarketMinute · January 30, 2026

The U.S. bond market is witnessing a significant recalibration as the 10-Year Treasury yield climbed to a pivotal 4.24% today, January 30, 2026. This surge, fueled by a combination of persistent "low-grade fever" inflation and heightened geopolitical friction, was further solidified by President Donald Trump’s official nomination

Via MarketMinute · January 30, 2026

The final week of January 2026 has been defined by a return to "tariff diplomacy" and a surreal geopolitical standoff over the world’s largest island, sending ripples of volatility through the S&P 500. President Trump’s dual-track strategy of threatening 100% tariffs on Canadian goods while simultaneously pressuring

Via MarketMinute · January 30, 2026

The U.S. housing market faced a chilling end to 2025 as the National Association of Realtors (NAR) reported a staggering 9.3% plunge in pending home sales for December. This sharp month-over-month decline pushed contract signings to their lowest level since the onset of the COVID-19 pandemic in 2020,

Via MarketMinute · January 30, 2026

The United States labor market once again demonstrated its remarkable durability as initial jobless claims for the week ending January 24, 2026, fell to a seasonally adjusted 200,000. This figure arrived significantly lower than the consensus forecast of 206,000, signaling that despite high interest rates and a cooling

Via MarketMinute · January 30, 2026

The global precious metals market suffered its most violent "flash crash" in recent history today, January 30, 2026, as a "perfect storm" of hawkish U.S. monetary policy signals and massive technical liquidations erased months of gains in a matter of hours. Gold prices, which had reached a staggering peak

Via MarketMinute · January 30, 2026

The year 2026 has opened with a seismic shift in the global technology landscape as rumors intensify surrounding Elon Musk’s long-teased "Everything Company." Recent reports and corporate filings suggest that the billionaire entrepreneur is moving toward a massive consolidation of his primary ventures, potentially merging the aerospace giant SpaceX

Via MarketMinute · January 30, 2026

SEATTLE — In a move that has sent tremors through Silicon Valley and Wall Street, reports surfaced today, January 30, 2026, that Amazon.com Inc. (NASDAQ:AMZN) is in advanced negotiations to invest a staggering $50 billion into OpenAI. This unprecedented capital injection, if finalized, would mark the largest single investment

Via MarketMinute · January 30, 2026

Exxon Mobil Corporation (NYSE:XOM) reported fourth-quarter 2025 earnings today that surpassed Wall Street expectations, demonstrating the energy giant’s ability to generate significant cash flow even as global crude prices retreated. The company posted an adjusted earnings per share (EPS) of $1.71, beating the analyst consensus of $1.

Via MarketMinute · January 30, 2026

SAN RAMON, CA — Chevron Corporation (NYSE: CVX) reported its fourth-quarter 2025 financial results this morning, delivering an earnings surprise that has caught Wall Street's attention. Despite a backdrop of cooling global oil prices and a year-over-year dip in total revenue, the energy giant managed to beat analyst expectations on the

Via MarketMinute · January 30, 2026

In a pivotal moment for the electric vehicle pioneer, Tesla, Inc. (NASDAQ: TSLA) reported fourth-quarter 2025 earnings that defied pessimistic forecasts, triggering a relief rally across the technology and automotive sectors. Despite posting its first annual revenue contraction in company history, Tesla delivered a significant beat on adjusted earnings per

Via MarketMinute · January 30, 2026

In a high-stakes moment for the technology sector, Apple (NASDAQ: AAPL) delivered a resounding rebuke to skeptics on January 29, 2026, reporting record-breaking results for its holiday quarter. While the company’s stock has spent much of the past year acting as a significant weight on the S&P 500

Via MarketMinute · January 30, 2026

The U.S. economy was met with a stark awakening on January 30, 2026, as the Bureau of Labor Statistics released the December 2025 Producer Price Index (PPI) report, revealing a significant and unexpected jump in wholesale inflation. Headline PPI rose by 0.5% on a month-over-month basis, more than

Via MarketMinute · January 30, 2026

Wall Street etched a new chapter in financial history this week as the S&P 500 index briefly surged past the 7,000-point threshold for the first time, marking a breathtaking ascent that has redefined investor expectations for the decade. On January 28, 2026, the benchmark index touched an intraday

Via MarketMinute · January 30, 2026

In a move that signals a seismic shift in American monetary policy, President Donald Trump has officially nominated former Federal Reserve Governor Kevin Warsh to succeed Jerome Powell as the Chair of the Federal Reserve. The announcement, made on January 30, 2026, marks the beginning of the end for the

Via MarketMinute · January 30, 2026

On January 30, 2026, the financial landscape underwent a seismic shift as President Donald Trump officially announced his nomination of former Federal Reserve Governor Kevin Warsh to succeed Jerome Powell as the next Chair of the Federal Reserve. The announcement, delivered via a series of posts on Truth Social, characterizes

Via MarketMinute · January 30, 2026

The early weeks of 2026 have delivered a seismic shock to the high-end retail sector, as the long-feared “Debt Wall” finally claimed its most prestigious victims. On January 13, 2026, Saks Global—the powerhouse formed by the ambitious merger of Saks Fifth Avenue, Neiman Marcus, and Bergdorf Goodman—filed for

Via MarketMinute · January 30, 2026

EchoStar Corporation (NASDAQ: SATS) experienced a dramatic surge in stock volatility this week, culminating in a sharp double-digit decline on January 29, 2026. The turbulence follows reports that SpaceX is in advanced negotiations to merge with xAI, Elon Musk’s artificial intelligence venture, in a deal that could create a

Via MarketMinute · January 30, 2026

IRVING, Texas — Exxon Mobil (NYSE: XOM) delivered a resounding message to the energy markets on Friday, January 30, 2026, reporting fourth-quarter 2025 earnings that surpassed Wall Street expectations. The oil giant’s performance was anchored by a massive surge in domestic oil and gas production, particularly in the Permian Basin,

Via MarketMinute · January 30, 2026

Shares of Intel Corp. (NASDAQ: INTC) experienced a historic rally on Wednesday, January 28, 2026, surging 11.04% to close at $48.78. This performance marks the stock’s best single-day gain since April 2025, a period widely considered the "execution floor" of the company's multi-year turnaround. The surge was

Via MarketMinute · January 30, 2026

The global gaming landscape was shaken this week as Las Vegas Sands Corp. (NYSE: LVS) saw its shares crater by nearly 14% following the release of its fourth-quarter 2025 financial results. Despite delivering headline revenue and earnings figures that comfortably beat Wall Street estimates, the stock suffered its worst single-day

Via MarketMinute · January 30, 2026

The industrial sector faced a harsh reality check this week as United Rentals (NYSE: URI), the world’s largest equipment rental company, saw its shares dive by nearly 13% following the release of its fourth-quarter earnings and a surprisingly cautious revenue forecast for 2026. Despite coming off a record-breaking 2025,

Via MarketMinute · January 30, 2026

As of late January 2026, the artificial intelligence revolution has transitioned from a speculative sprint into a permanent industrial fixture, and at the center of this new world order stands Nvidia (NASDAQ: NVDA). Despite the rising tide of competition and intensifying regulatory scrutiny, the Santa Clara-based titan continues to exert

Via MarketMinute · January 30, 2026

The U.S. bond market sent a shudder through equity desks on Friday as the 10-year Treasury yield surged past the critical 4.27% threshold, hitting its highest level in 18 months. This sharp ascent, driven by a combination of hawkish shifts in Federal Reserve leadership and robust economic growth

Via MarketMinute · January 30, 2026

In a month that will be etched into financial history books, gold prices surged to an unprecedented all-time high of $5,608 per ounce on January 29, 2026, driven by a "perfect storm" of escalating trade wars, Middle Eastern tensions, and mounting concerns over U.S. fiscal stability. The precious

Via MarketMinute · January 30, 2026

In a dramatic validation of its strategic pivot, Southwest Airlines Co. (NYSE: LUV) saw its stock price soar by 19% yesterday, January 29, 2026, marking its most significant single-day gain in years. The rally was ignited by a fourth-quarter earnings report that far exceeded Wall Street expectations, coupled with aggressive

Via MarketMinute · January 30, 2026

In a move that has sent shockwaves through the travel and leisure sector, shares of Royal Caribbean Group (NYSE: RCL) surged nearly 19% in a single trading session following the release of its fourth-quarter 2025 earnings. The rally, which saw the stock hit an all-time high of approximately $346 per

Via MarketMinute · January 30, 2026

MENLO PARK, CA — Meta Platforms (NASDAQ: META) shares skyrocketed nearly 10% in a historic trading session on January 29, 2026, following a fourth-quarter earnings report that fundamentally shifted the narrative around Big Tech’s massive artificial intelligence investments. The surge added approximately $170 billion to the company’s market capitalization,

Via MarketMinute · January 30, 2026

In a move that has stunned international markets and diplomatic circles, President Donald Trump escalated a simmering trade dispute with Canada into a full-blown aerospace crisis. On January 30, 2026, the President reinforced threats to impose a sweeping 50% tariff on all Canadian-built aircraft and—in a more radical move—

Via MarketMinute · January 30, 2026

In a historic display of market resilience and technological optimism, the S&P 500 index officially crossed the 7,000-point threshold on January 28, 2026. This monumental achievement marks a new era for Wall Street, coming just fourteen months after the index first touched 6,000 in late 2024. The

Via MarketMinute · January 30, 2026

The landscape of American luxury retail was fundamentally reshaped this month as Saks Global Holdings LLC officially filed for Chapter 11 bankruptcy protection. The filing, which took place in the U.S. Bankruptcy Court for the Southern District of Texas on January 13, 2026, marks a stunning reversal for a

Via MarketMinute · January 30, 2026

In a move that has sent shockwaves through global financial markets, President Donald Trump has officially nominated Kevin Warsh to succeed Jerome Powell as the next Chairman of the Federal Reserve. The announcement, made on the morning of January 30, 2026, marks the culmination of a year-long campaign by the

Via MarketMinute · January 30, 2026

As of January 30, 2026, Alphabet Inc. (NASDAQ:GOOGL) has solidified its position at the vanguard of the global technology sector, with its stock price continuing a relentless upward trajectory that began in late 2025. This sustained rally was ignited by a historic third-quarter earnings report that silenced critics and

Via MarketMinute · January 30, 2026

SANTA CLARA, CA — The stratospheric rise of the artificial intelligence sector faced a grueling reality check this week as shares of Advanced Micro Devices (NASDAQ:AMD) plummeted 11%, wiping out billions in market capitalization. The sell-off, which began following a series of conservative forecasts from industry peers and persistent rumors

Via MarketMinute · January 30, 2026

On October 30, 2024, the artificial intelligence sector experienced a seismic shock that would redefine investor expectations for the industry’s infrastructure giants. Super Micro Computer (Nasdaq: SMCI) saw its market capitalization crater by more than 33% in a single trading session—erasing nearly $10 billion in value—following the

Via MarketMinute · January 30, 2026

As of January 30, 2026, the global defense landscape has shifted from a period of reactive replenishment to a structural "Security Supercycle." Driven by intensifying multi-theater conflicts and a fundamental breakdown in the post-Cold War security architecture, global military expenditure has surged to a staggering $2.72 trillion. This milestone,

Via MarketMinute · January 30, 2026

In a definitive signal that the "cash sorting" crisis of years past has been relegated to the history books, The Charles Schwab Corporation (NYSE: SCHW) reported record-breaking fourth-quarter and full-year 2025 results on January 21, 2026. The brokerage behemoth posted a record $6.34 billion in quarterly revenue, a 19%

Via MarketMinute · January 30, 2026

As January 2026 draws to a close, the global financial markets are standing at the precipice of what many economists are calling the "AI Earnings Supercycle." After three years of intensive capital expenditure and experimental pilots, the narrative of artificial intelligence has shifted from speculative hype to a rigorous, margin-focused

Via MarketMinute · January 30, 2026

In a month characterized by dramatic market swings and heightening global tensions, silver has emerged as the clear victor in the precious metals space. In the final weeks of January 2026, spot silver prices witnessed a staggering 14% surge, culminating in a historic intraday peak that saw the metal briefly

Via MarketMinute · January 30, 2026

As of late January 2026, the industrial landscape has a singular titan leading the charge: GE Aerospace (NYSE: GE). Following its transformation into a pure-play aviation powerhouse in 2024, the company spent 2025 rewriting the record books for the aerospace sector. However, after releasing its Q4 and full-year 2025 earnings

Via MarketMinute · January 30, 2026

DALLAS — AT&T (NYSE: T) reported its fourth-quarter and full-year 2025 financial results this week, delivering a decisive "double beat" that suggests the telecommunications giant has successfully transitioned from a period of restructuring into a phase of durable growth. Despite an environment defined by aggressive pricing from cable competitors and

Via MarketMinute · January 30, 2026

In its fourth-quarter and full-year 2025 earnings report delivered on January 27, 2026, American Airlines (NASDAQ:AAL) signaled a decisive shift in its corporate identity. The Fort Worth-based carrier reported a record-breaking $14.0 billion in quarterly revenue, bringing its full-year 2025 total to a staggering $54.6 billion. However,

Via MarketMinute · January 30, 2026

ServiceNow (NYSE: NOW) reported a powerhouse performance for its fourth quarter of 2025, beating analyst estimates across the board as its generative AI (GenAI) strategy moved from pilot programs to a significant revenue engine. On January 28, 2026, the workflow automation giant posted subscription revenue of $3.47 billion, a

Via MarketMinute · January 30, 2026

The global financial landscape at the start of 2026 remains a study in contradictions, yet for Mastercard (NYSE: MA), the narrative is one of undeniable strength. Following its fourth-quarter earnings release on January 29, 2026, the payments giant has signaled that while the global consumer is becoming more "intentional" and

Via MarketMinute · January 30, 2026

The global financial landscape has been jolted by a profound "Greenland rift" as the United States aggressively asserts its territorial ambitions over the autonomous Danish territory. This geopolitical friction, which reached a fever pitch in January 2026, has pitted Washington against Copenhagen and Brussels, triggering an unprecedented deployment of European

Via MarketMinute · January 30, 2026

The Federal Reserve concluded its first policy meeting of the year on January 28, 2026, electing to maintain the federal funds rate at its current target range of 3.50% to 3.75%. This decision marks a "strategic pause" in the central bank's easing cycle, following three consecutive rate reductions

Via MarketMinute · January 30, 2026

The long-standing economic alliance between the United States and Canada reached a perilous breaking point this week. As of January 30, 2026, the North American trading block—once the most integrated and prosperous in the world—is staring down a "nuclear" economic option. President Donald Trump, entering the second year

Via MarketMinute · January 30, 2026

In a historic shift that has reverberated through every corner of the global financial system, gold prices surged past the $5,000 per ounce milestone this week, closing at an unprecedented $5,306 on January 30, 2026. This monumental rally marks a nearly 90% increase in just twelve months, fundamentally

Via MarketMinute · January 30, 2026

As of January 30, 2026, the aerospace industry is still dissecting the complex financial narrative released earlier this week by The Boeing Company (NYSE: BA). In its fourth-quarter and full-year 2025 earnings report, the aviation giant demonstrated that while it is successfully hauling itself out of what CEO Kelly Ortberg

Via MarketMinute · January 30, 2026

The global financial markets are currently navigating what many analysts have described as the most pivotal week of the decade. As of Friday, January 30, 2026, the tech-heavy indexes are reeling from a high-stakes "triple threat" of earnings reports from Meta Platforms, Microsoft, and Tesla that were released over the

Via MarketMinute · January 30, 2026