Articles from Santander Holdings USA, Inc.

Santander Holdings USA, Inc. (“Santander US”) today announced findings from the latest Santander US Paths to Financial Prosperity study showing middle-income Americans’ continued resilience and optimism, even as inflation concerns persist. Results from the Q4 2025 survey show that consumers’ confidence in achieving financial prosperity remains at a three-year high, with 79% believing they are on the right track. This is further supported by households indicating that they feel secure in their jobs and are better able to manage prices.

By Santander Holdings USA, Inc. · Via Business Wire · January 29, 2026

Santander Holdings USA, Inc. (“Santander US”) announced that David McClelland has been named Head of the Santander US Auto business, effective today. McClelland will be responsible for executing on the company’s Auto growth strategy, enhancing dealer and customer experiences, and managing manufacturer (OEM) relationships. In this capacity, he succeeds Bruce Jackson, who announced his retirement from the company.

By Santander Holdings USA, Inc. · Via Business Wire · January 26, 2026

Today, Santander US announced a multi-year partnership with Villanova University Athletics naming Santander the Official Retail Bank Partner of Villanova Athletics and awarding a $1 million grant to Villanova University to provide scholarships for 50 student-athletes.

By Santander Holdings USA, Inc. · Via Business Wire · December 22, 2025

Santander Holdings USA, Inc. (“Santander US”) today announced new survey findings that show middle-income Americans have accelerated their car buying timelines amid uncertainty about future prices. While 52% had delayed a vehicle purchase over the past year due to cost, 55% are now considering buying in the year ahead, up from 47% in Q1. This is the first time in eight quarters of research that prospective buyers outnumber those delaying a purchase—indicating that pent-up demand may be transitioning to sales activity. Additionally, 18% expedited key purchases in Q2 to get ahead of any price changes, with 41% of them buying a vehicle.

By Santander Holdings USA, Inc. · Via Business Wire · July 28, 2025

Santander US today announced a $25 million commitment in support of education, employability and entrepreneurship that will include over $10 million in university grants and national scholarship funding through the Santander Universities program. The scholarship applications will be available later this Summer on Santander Open Academy, a global platform available to anyone around the world that offers 100% free educational content and upskilling tools to improve professional skills and employability.

By Santander Holdings USA, Inc. · Via Business Wire · July 14, 2025

The Board of Governors of the Federal Reserve System (the “Federal Reserve”) informed Santander Holdings USA, Inc. (“SHUSA”) on June 27, 2025, of SHUSA’s updated stress capital buffer (“SCB”) requirement, which becomes effective on October 1, 2025. SHUSA’s updated SCB will be 3.4% of its common equity Tier 1 capital (“CET1”), resulting in an overall CET1 capital requirement of 7.9%.

By Santander Holdings USA, Inc. · Via Business Wire · July 1, 2025

Santander Holdings USA, Inc. (“Santander US”) today announced new survey findings that show a rise in pent-up auto demand as middle-income Americans return to the workplace, with more than four in 10 (42%) having increased the number of days they drive to work over the last year. While 52% delayed buying a vehicle in the last 12 months due to cost, 47% are considering a vehicle purchase in the year ahead, up from 41% in mid-2023. These prospective buyers are feeling a sense of urgency amid recent price uncertainty. Of those considering a vehicle purchase, two-thirds believe auto prices will increase over the next three months, and 53% are more likely to purchase during that time due to rising cost concerns. The interest in vehicles comes at a time when middle-income consumers are confident in their own finances. Nearly eight in 10 (77%) believe they are on the right track to financial prosperity, a new survey high, while 18% feel financially insecure, a new low.

By Santander Holdings USA, Inc. · Via Business Wire · April 2, 2025

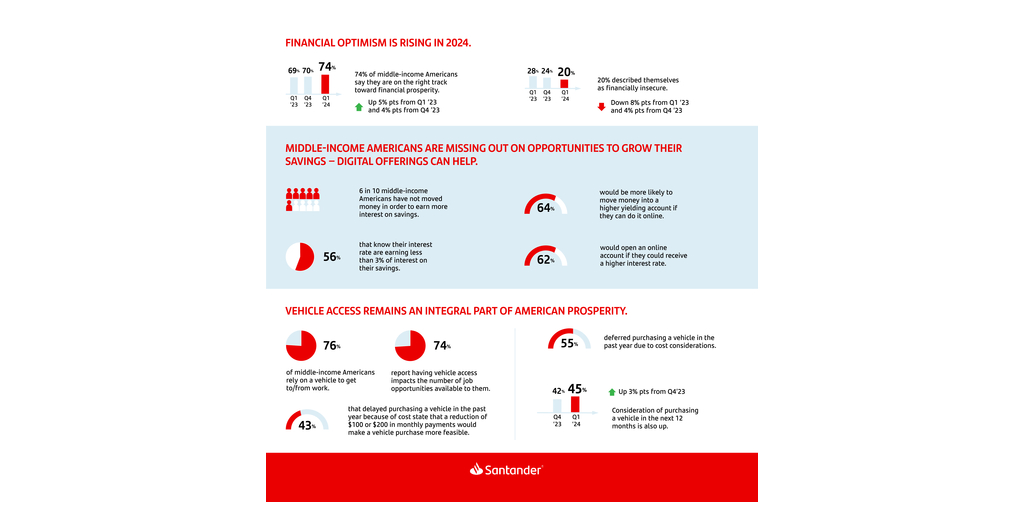

Santander Holdings USA, Inc. (“Santander US”) today announced new survey findings that show middle-income consumers are feeling optimistic about the economy and their own financial prospects in 2025. Expectations of a recession in the year ahead dropped 17 percentage points in the past year, while nearly two-thirds of middle-income households (64%) believe the job market will be stronger in 2025 and 6 in 10 expect inflation to improve. The bullishness on the economy is translating into consumer confidence in 2025, with 76% of middle-income households expecting their financial situations to improve and 74% believing they are on the right track.

By Santander Holdings USA, Inc. · Via Business Wire · January 23, 2025

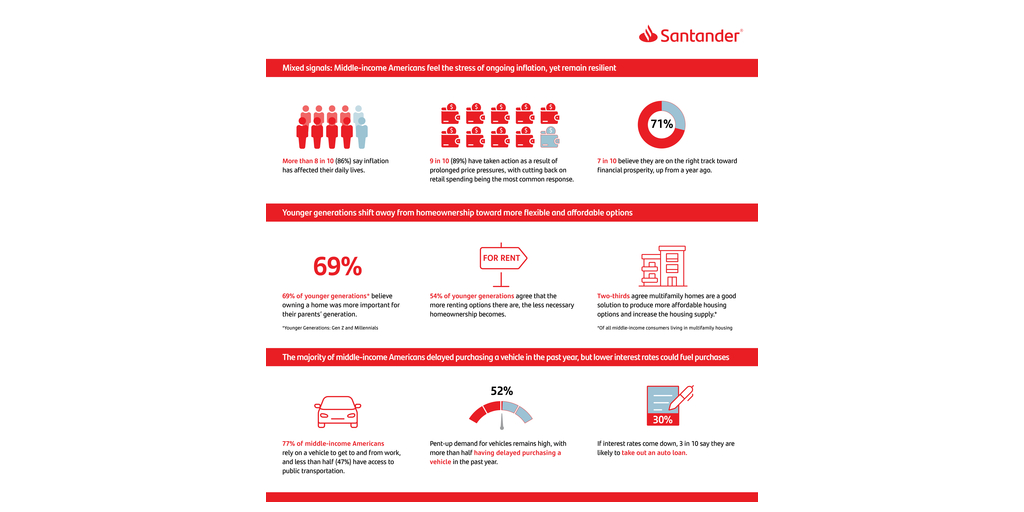

Santander Holdings USA, Inc. (“Santander US”) today announced new findings from a survey that shows while middle-income Americans remain optimistic about their financial futures, they continue to navigate inflationary pressures and recession concerns. More consumers (81%) consider inflation a major concern in Q3, and 86% say it has impacted their daily lives. Despite this trend, consumers remain resilient. Most middle-income Americans (76%) say they have remained current on their bills, and more of them (71%) say they are on the right track toward financial prosperity than a year ago.

By Santander Holdings USA, Inc. · Via Business Wire · October 8, 2024

The Board of Governors of the Federal Reserve System (the “Federal Reserve”) informed Santander Holdings USA, Inc. (“SHUSA”) on June 26, 2024, of SHUSA’s updated stress capital buffer (“SCB”) requirement, which becomes effective on October 1, 2024. SHUSA’s updated SCB will be 3.5% of its Common Equity Tier 1 capital (CET1) resulting in an overall CET1 capital requirement of 8.0%.

By Santander Holdings USA, Inc. · Via Business Wire · June 28, 2024

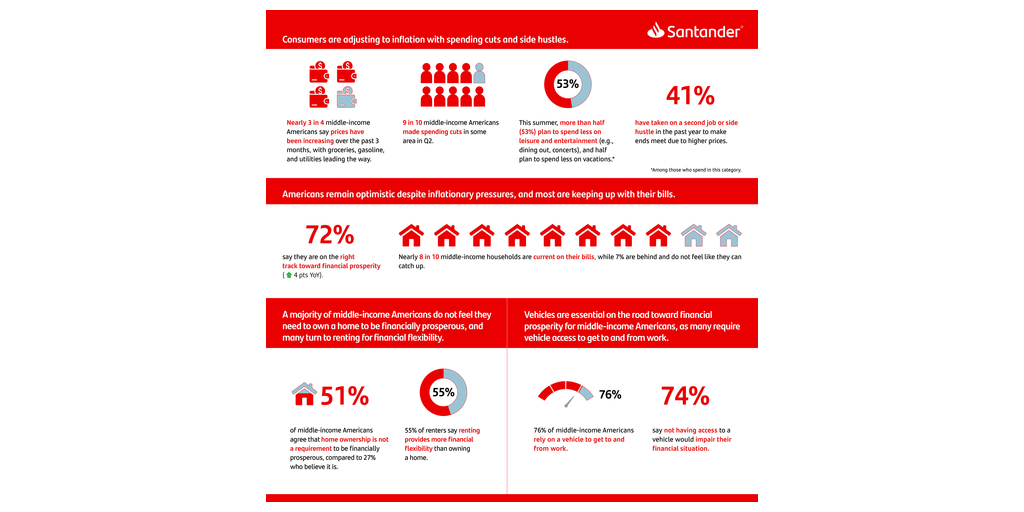

Santander Holdings USA, Inc. (“Santander US”) today announced findings from a new survey that shows middle-income households are cutting back on spending, taking second jobs, and delaying large purchases—such as cars and homes—to adapt to higher prices as inflationary pressures continue. Nearly three in four middle-income households (72%) reported seeing prices rise in the second quarter, and four in five (78%) said inflation is a major concern. To cope, most middle-income households (90%) have made spending cuts in at least one area, and many plan to curtail spending on a range of items this summer—from vacations to entertainment to summer camps and childcare. Four in 10 said they have taken on a second job or side gig in the last 12 months to help make ends meet.

By Santander Holdings USA, Inc. · Via Business Wire · June 24, 2024

Santander Holdings USA, Inc. (“Santander US”) today announced findings from its recent Paths to Prosperity survey showing middle-income Americans are optimistic about their financial futures, with 74% believing they are on the right track toward financial prosperity during the first quarter of 2024.

By Santander Holdings USA, Inc. · Via Business Wire · April 2, 2024

Santander Holdings USA, Inc. (“ Santander US”) today announced findings from a new survey that shows middle-income American consumers were feeling optimistic in the fourth quarter of 2023, with 70% of respondents believing they are on the right track toward achieving financial prosperity and 80% believing they would achieve financial prosperity in the next 10 years. Less than a quarter described themselves as “financially insecure,” down four percentage points from the first quarter. Meanwhile, seven in 10 said they were spending at least as much as the previous year if not more on holiday gift giving, and a majority said they believed their gift giving reflects their own financial prosperity.

By Santander Holdings USA, Inc. · Via Business Wire · January 17, 2024

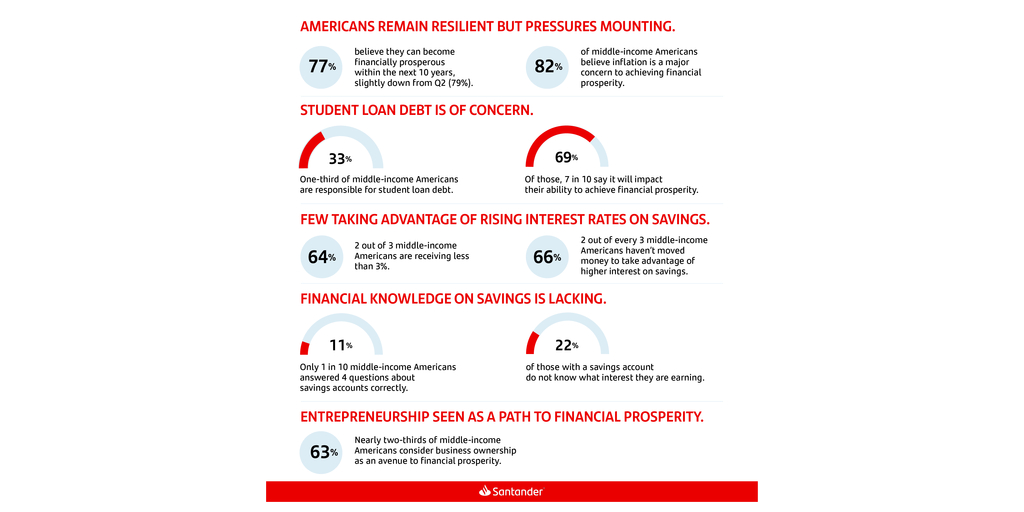

Santander Holdings USA, Inc. (“Santander US”) today announced findings from a new survey that shows American consumers are optimistic about their futures despite mounting financial pressures. The results found 68% of middle-income households believe they are on the right track toward achieving financial prosperity, which remains unchanged from Q2.

By Santander Holdings USA, Inc. · Via Business Wire · October 30, 2023

Santander Holdings USA, Inc. (“Santander US”) today announced findings from a new survey showing Americans remain optimistic about their financial prospects, despite strong concerns about inflation. The results show 68% of middle-income households believe they are on the right track toward financial success, relatively unmoved from the first quarter. While inflation is a top concern for most respondents (80%), just 3% considered recent bank failures a barrier to their financial prosperity.

By Santander Holdings USA, Inc. · Via Business Wire · July 24, 2023

Santander Holdings USA, Inc. (“Santander US”) today released the 2022 Prosperity with Purpose Report, its annual Environmental, Social and Governance report detailing current commitments and efforts to help advance sustainability in our communities.

By Santander Holdings USA, Inc. · Via Business Wire · June 28, 2023

Santander Holdings USA, Inc. (“Santander US”) today announced its latest Community Plan, a three-year commitment of $4.6 billion in community reinvestment and $9 billion in sustainable finance, on behalf of Santander’s businesses across the United States, which will provide broad commitments for community development for affordable housing, small business, and supplier diversity, as well as $100 million in charitable giving and 100,000 employee volunteer hours.

By Santander Holdings USA, Inc. · Via Business Wire · June 21, 2023

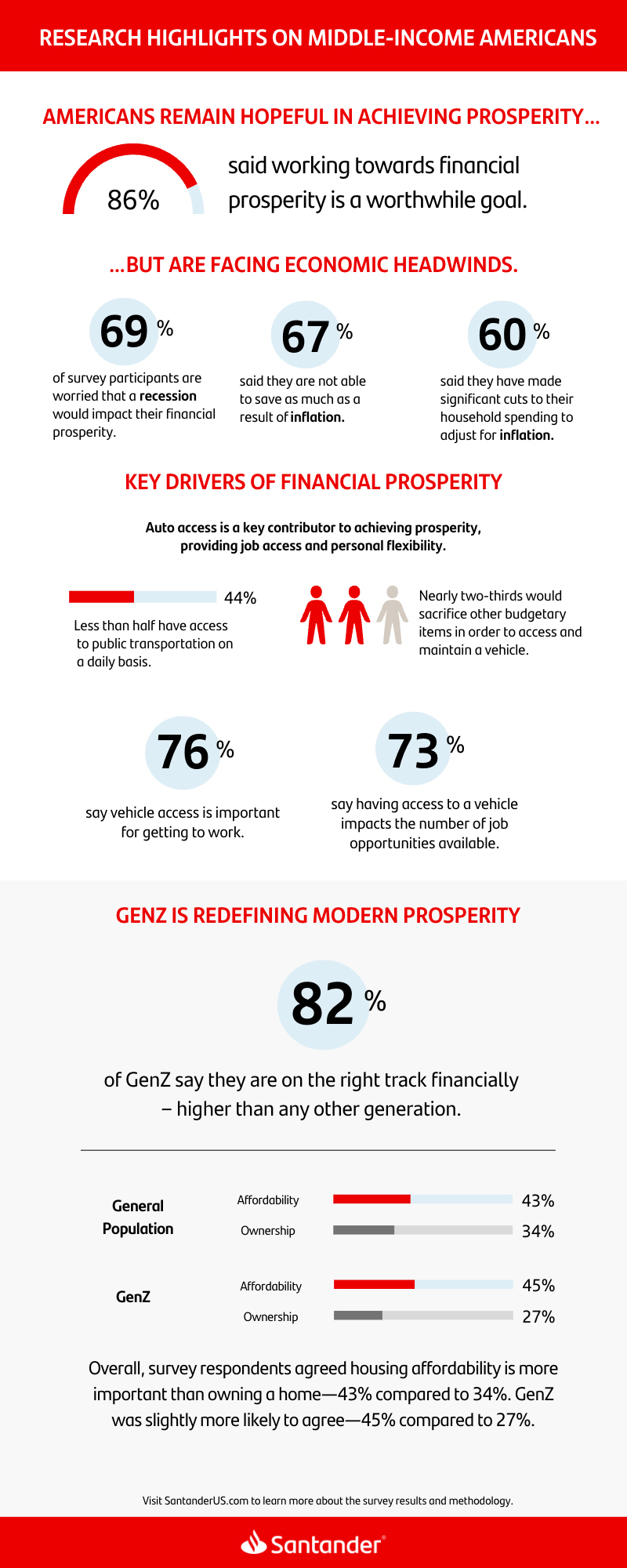

Santander Holdings USA, Inc. (“Santander US”) today announced findings from a new survey of middle-income Americans, which revealed that 86% of respondents believe financial prosperity remains a worthwhile goal, with 79% optimistic that they will achieve it within the next decade, despite current headwinds.

By Santander Holdings USA, Inc. · Via Business Wire · March 29, 2023

Santander Holdings USA, Inc. (“Santander” and “Santander US”) today announced that, effective March 2023, Bruce Jackson will assume the role of head of the Santander US Auto business and CEO of Santander Consumer USA Inc. (“Santander Consumer”), reporting to Santander US CEO, Tim Wennes. Jackson succeeds Mahesh Aditya who is taking on the role of Banco Santander's Group Chief Risk officer in Madrid, subject to customary regulatory approvals.

By Santander Holdings USA, Inc. · Via Business Wire · December 22, 2022

Santander Holdings USA, Inc. (“Santander” and “Santander US”) today announced the completion of the sixth cohort of Santander’s Cultivate Small Business, which served 97 entrepreneurs and awarded $300,000 in capital grants to eligible graduates. The cohort’s graduates are the program’s first from the Dallas, Miami and Philadelphia markets. The program also operates in Massachusetts, New Jersey and New York.

By Santander Holdings USA, Inc. · Via Business Wire · December 16, 2022

Santander Holdings USA, Inc. (“Santander US” and “Santander”) announced its first sustainable bond offering on Sept. 6. Santander US is the first Santander Group entity to issue bonds of this kind, utilizing Santander Group’s recently released Green, Social & Sustainability Funding Global Framework (the “Framework”).

By Santander Holdings USA, Inc. · Via Business Wire · September 27, 2022

Santander Holdings USA, Inc. (“Santander US” and “Santander”) today announced a $2.5 million, three-year commitment to its longstanding community partner City Year, an AmeriCorps network member supporting under-resourced public schools in the U.S. Santander US unveiled the multimillion-dollar commitment at an event it hosted featuring Rafael Nadal, professional tennis player and Santander ambassador, for 25 middle-school students from City Year supported schools in East Harlem and the South Bronx.

By Santander Holdings USA, Inc. · Via Business Wire · August 25, 2022

Santander Holdings USA, Inc. (“Santander US” and “Santander”) today announced that it is has released its 2021 Environmental, Social and Governance (“ESG”) report. The report highlight’s Santander’s commitment to building paths to prosperity through strategic work in three pillars: empowering people and businesses, fostering inclusive communities and supporting the green economy.

By Santander Holdings USA, Inc. · Via Business Wire · August 8, 2022

Santander Holdings USA, Inc. ("SHUSA” or the “Company”) commented on the results of the Federal Reserve’s 2022 Supervisory Stress Test Results.

By Santander Holdings USA, Inc. · Via Business Wire · June 23, 2022

Santander Holdings USA, Inc. ("Santander US” and “Santander”) announced today that it will increase its minimum hourly wage to $20, nearly triple the federal minimum wage and higher than the minimum wage offered by most leading competitors. The wage hike is available to Santander Bank, N.A. and Santander Consumer (“SC”) USA employees who work onsite in branches, call centers and corporate offices.

By Santander Holdings USA, Inc. · Via Business Wire · March 30, 2022

Santander Holdings USA, Inc. (“SHUSA”) today announced that it has closed its acquisition of all outstanding shares of common stock of Santander Consumer USA Holdings Inc. (“SC”) not already owned by SHUSA following the completion of SHUSA’s previously announced tender offer (the “Tender Offer”) to acquire such shares of common stock of SC for $41.50 per share.

By Santander Holdings USA, Inc. · Via Business Wire · January 31, 2022

Santander Holdings USA, Inc. (“SHUSA”) today announced that the Board of Governors of the Federal Reserve System (the “Federal Reserve Board”) has approved the acquisition of all outstanding shares of common stock of Santander Consumer USA Holdings Inc. (“SC”) not already owned by SHUSA and that SHUSA’s previously announced tender offer (the “Tender Offer”) to acquire such shares of common stock of SC for $41.50 per share (the “Offer Price”) has expired.

By Santander Holdings USA, Inc. · Via Business Wire · January 28, 2022

Santander Holdings USA, Inc. (“SHUSA”) today announced that it has extended the expiration date of its previously announced tender offer (the “Tender Offer”) to acquire all outstanding shares of common stock of Santander Consumer USA Holdings Inc. (“SC”) not already owned by SHUSA for $41.50 per share (the “Offer Price”).

By Santander Holdings USA, Inc. · Via Business Wire · January 21, 2022

Santander Holdings USA, Inc. (“SHUSA”) today announced that it has extended the expiration date of its previously announced tender offer (the “Tender Offer”) to acquire all outstanding shares of common stock of Santander Consumer USA Holdings Inc. (“SC”) not already owned by SHUSA for $41.50 per share (the “Offer Price”).

By Santander Holdings USA, Inc. · Via Business Wire · January 13, 2022

Santander Holdings USA, Inc. (“SHUSA”) today announced that it has extended the expiration date of its previously announced tender offer (the “Tender Offer”) to acquire all outstanding shares of common stock of Santander Consumer USA Holdings Inc. (“SC”) not already owned by SHUSA for $41.50 per share (the “Offer Price”).

By Santander Holdings USA, Inc. · Via Business Wire · January 6, 2022

Santander Holdings USA, Inc. (“SHUSA”) today announced that it has extended the expiration date of its previously announced tender offer (the “Tender Offer”) to acquire all outstanding shares of common stock of Santander Consumer USA Holdings Inc. (“SC”) not already owned by SHUSA for $41.50 per share (the “Offer Price”).

By Santander Holdings USA, Inc. · Via Business Wire · December 30, 2021

Santander Holdings USA, Inc. (“SHUSA”) today announced that it has extended the expiration date of its previously announced tender offer (the “Tender Offer”) to acquire all outstanding shares of common stock of Santander Consumer USA Holdings Inc. (“SC”) not already owned by SHUSA for $41.50 per share (the “Offer Price”).

By Santander Holdings USA, Inc. · Via Business Wire · December 27, 2021

Santander Holdings USA, Inc. (“SHUSA”) today announced that it has extended the expiration date of its previously announced tender offer (the “Tender Offer”) to acquire all outstanding shares of common stock of Santander Consumer USA Holdings Inc. (“SC”) not already owned by SHUSA for $41.50 per share (the “Offer Price”).

By Santander Holdings USA, Inc. · Via Business Wire · December 17, 2021

Santander Holdings USA, Inc. (“SHUSA”) today announced that it has extended the expiration date of its previously announced tender offer (the “Tender Offer”) to acquire all outstanding shares of common stock of Santander Consumer USA Holdings Inc. (“SC”) not already owned by SHUSA for $41.50 per share (the “Offer Price”).

By Santander Holdings USA, Inc. · Via Business Wire · December 10, 2021

Santander Holdings USA, Inc. (“SHUSA”) today announced that it has extended the expiration date of its previously announced tender offer (the “Tender Offer”) to acquire all outstanding shares of common stock of Santander Consumer USA Holdings Inc. (“SC”) not already owned by SHUSA for $41.50 per share (the “Offer Price”).

By Santander Holdings USA, Inc. · Via Business Wire · December 3, 2021

Santander Holdings USA, Inc. (“SHUSA”) today announced that it has extended the expiration date of its previously announced tender offer (the “Tender Offer”) to acquire all outstanding shares of common stock of Santander Consumer USA Holdings Inc. (“SC”) not already owned by SHUSA for $41.50 per share (the “Offer Price”).

By Santander Holdings USA, Inc. · Via Business Wire · November 18, 2021

Santander Holdings USA, Inc. (“SHUSA”) today announced that it has extended the expiration date of its previously announced tender offer (the “Tender Offer”) to acquire all outstanding shares of common stock of Santander Consumer USA Holdings Inc. (“SC”) not already owned by SHUSA for $41.50 per share (the “Offer Price”).

By Santander Holdings USA, Inc. · Via Business Wire · November 10, 2021

Santander Holdings USA, Inc. (“SHUSA”) today announced that it has extended the expiration date of its previously announced tender offer (the “Tender Offer”) to acquire all outstanding shares of common stock of Santander Consumer USA Holdings Inc. (“SC”) not already owned by SHUSA for $41.50 per share (the “Offer Price”).

By Santander Holdings USA, Inc. · Via Business Wire · November 3, 2021

Santander Holdings USA, Inc. (“SHUSA”) today announced that it has extended the expiration date of its previously announced tender offer (the “Tender Offer”) to acquire all outstanding shares of common stock of Santander Consumer USA Holdings Inc. (“SC”) not already owned by SHUSA for $41.50 per share (the “Offer Price”).

By Santander Holdings USA, Inc. · Via Business Wire · October 20, 2021

Santander Holdings USA, Inc. (“SHUSA”) today announced that it has extended the expiration date of its previously announced tender offer (the “Tender Offer”) to acquire all outstanding shares of common stock of Santander Consumer USA Holdings Inc. (“SC”) not already owned by SHUSA for $41.50 per share (the “Offer Price”).

By Santander Holdings USA, Inc. · Via Business Wire · October 5, 2021

Santander Holdings USA (“SHUSA” and “Santander”) today announced that Ashwani Aggarwal has been named Chief Risk Officer, effective today, August 24, 2021. Aggarwal will report to Santander US CEO Tim Wennes. Ashwani joined Santander in 2019, and most recently served as Head of Risk Analytics & Chief Model Risk Officer.

By Santander Holdings USA, Inc. · Via Business Wire · August 24, 2021

Santander Holdings USA, Inc. (“SHUSA”) today announced that SHUSA and Santander Consumer USA Holdings Inc. (“SC”) have entered into a definitive agreement pursuant to which SHUSA will acquire all outstanding shares of common stock of SC not already owned by SHUSA via an all-cash tender offer (the “Tender Offer”) for $41.50 per share (the “Offer Price”), followed by a second-step merger (the “Merger” and together with the Tender Offer, the “Transaction”), in which a wholly owned subsidiary of SHUSA will be merged with and into SC, with SC surviving as a wholly owned subsidiary of SHUSA, and all outstanding shares of common stock of SC not tendered in the Tender Offer will be converted into the right to receive the Offer Price in cash. The Offer Price represents a 14% premium to the closing price of SC common stock of $36.43 as of July 1, 2021, the last day prior to the announcement of SHUSA’s initial offer to acquire the remaining outstanding shares of SC’s common stock. SHUSA currently owns approximately 80% of SC’s outstanding shares of common stock.

By Santander Holdings USA, Inc. · Via Business Wire · August 24, 2021

Santander Holdings USA, Inc. (“Santander US” or “Santander”) announced that Laura Burke has been named Santander US Chief Communications Officer, reporting to Jennifer Mathissen, Chief Marketing Officer for Santander Bank, N.A. Burke also joins the Santander US leadership team, headed by Santander US CEO Tim Wennes.

By Santander Holdings USA, Inc. · Via Business Wire · August 23, 2021

Santander Holdings USA, Inc. (“SHUSA”) today announced that it submitted a proposal to Santander Consumer USA Holdings Inc. (“SC”) yesterday to acquire all outstanding shares of common stock of SC not already owned by SHUSA for $39.00 per share in cash. The proposal represents a 7.4% premium to Wednesday’s closing price of $36.32 and a 30.4% premium to SC’s average share price since January 1, 2021. SHUSA currently owns approximately 80% of SC’s outstanding shares of common stock and, if the transaction is completed, SC would become a wholly-owned subsidiary of SHUSA.

By Santander Holdings USA, Inc. · Via Business Wire · July 2, 2021