Freeport-McMoRan (FCX)

59.36

-3.30 (-5.27%)

NYSE · Last Trade: Mar 7th, 11:07 PM EST

Via MarketBeat · March 6, 2026

Exploring the top movers within the S&P500 index during today's session.chartmill.com

Via Chartmill · March 6, 2026

As of March 6, 2026, a seismic shift has taken hold of the global financial markets, marking what analysts are calling the "Great Sector Rotation." For years, the market’s momentum was dictated by the "Magnificent Seven" and a seemingly unstoppable surge in Artificial Intelligence (AI) valuations. However, in the

Via MarketMinute · March 6, 2026

These S&P500 stocks are gapping in today's sessionchartmill.com

Via Chartmill · March 3, 2026

The global financial landscape has shifted dramatically as the first quarter of 2026 draws to a close. After years of relentless strength that pressured global trade and emerging markets, the U.S. Dollar Index (DXY) has finally begun a sustained retreat, falling from its 2025 peaks to stabilize in the

Via MarketMinute · March 6, 2026

As of today, March 6, 2026, the global commodity markets are navigating a period of profound structural change. At the center of this transformation is copper—the "metal of electrification." Freeport-McMoRan (NYSE: FCX) stands as the world’s leading publicly traded copper producer and a critical linchpin in the global supply chain. With copper prices hovering near [...]

Via Finterra · March 6, 2026

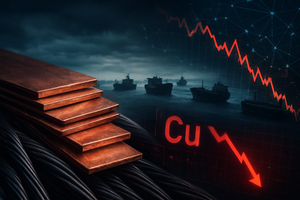

Copper prices on the London Metal Exchange (LME) experienced a sharp 1.6% decline on Friday, March 6, 2026, settling near $13,131 per metric ton. This retreat marks a significant cooling period for the industrial bellwether, which had reached historic highs above $14,500 just two months prior. The

Via MarketMinute · March 6, 2026

Explore the top gainers and losers within the S&P500 index in today's session.chartmill.com

Via Chartmill · March 5, 2026

What's going on in today's session: S&P500 moverschartmill.com

Via Chartmill · March 5, 2026

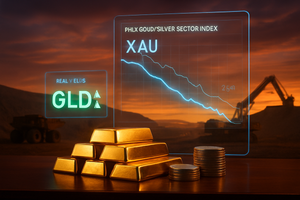

The precious metals sector has staged a remarkable rally in early March 2026, as the PHLX Gold/Silver Sector Index (XAU) tests historic highs amid a massive influx of institutional capital. Driven by a significant decline in inflation-adjusted "real" yields, investors have aggressively rotated into gold-backed assets, resulting in over

Via MarketMinute · March 5, 2026

Thursday's session: gap up and gap down stock in the S&P500 indexchartmill.com

Via Chartmill · March 5, 2026

The historic rally in the copper market, which propelled the industrial metal to unprecedented heights earlier this year, has come to a jarring halt. On March 4, 2026, copper prices plummeted in a massive reversal, signaling the end of a speculative frenzy that had gripped global markets since the start

Via MarketMinute · March 4, 2026

Get insights into the top movers in the S&P500 index of Tuesday's pre-market session.chartmill.com

Via Chartmill · March 3, 2026

The global commodity market is currently navigating a period of intense volatility as a series of short-term supply shocks clash with a looming long-term surplus. According to the World Bank’s latest Commodity Markets Outlook, the start of 2026 has been defined by a sharp reversal of the downward trend

Via MarketMinute · March 2, 2026

The copper market has entered a period of intense turbulence as the "red metal" undergoes a significant price reversal following a historic rally. Just weeks after the London Metal Exchange (LME) benchmark soared to an all-time high of $13,387.50 per tonne in early January 2026, prices have begun

Via MarketMinute · March 2, 2026

As of March 2, 2026, the global economy finds itself at a critical crossroads in the transition toward a decarbonized future. At the center of this shift is Freeport-McMoRan Inc. (NYSE: FCX), a premier international mining company and the world’s largest publicly traded producer of copper. While energy markets have historically been dominated by oil [...]

Via Finterra · March 2, 2026

As of March 2, 2026, Newmont Corporation (NYSE: NEM) stands as the undisputed titan of the global gold mining industry. Coming off a historic 2025 that saw gold prices test the $5,000 per ounce mark, Newmont has successfully transitioned from a period of aggressive, multi-billion-dollar acquisitions to a phase of disciplined, high-margin execution. The company [...]

Via Finterra · March 2, 2026

NUUK, GREENLAND — In a dramatic pivot that has sent shockwaves of relief through global financial markets, the geopolitical standoff over Greenland has reached a definitive resolution. Following months of aggressive rhetoric concerning territorial acquisition and the looming threat of punitive "Security Tariffs," the United States and its European allies have

Via MarketMinute · February 27, 2026

In a week defined by economic uncertainty and shifting fiscal narratives, the Federal Reserve Bank of Kansas City released a bombshell manufacturing report on February 26, 2026, that has fundamentally altered the outlook for the U.S. industrial sector. The Tenth District Manufacturing Survey showed a surprise jump in the

Via MarketMinute · February 27, 2026

As of February 26, 2026, the S&P 500 has solidified its position in a new era of corporate prosperity, marking its fifth consecutive quarter of double-digit earnings growth. The index is currently tracking a blended growth rate of 13.2% for the final quarter of 2025, a figure that

Via MarketMinute · February 26, 2026

The global copper market is currently grappling with a baffling contradiction that analysts are calling the "Copper Paradox." As of February 26, 2026, copper prices on the London Metal Exchange (LME) have shattered historical records, surging past $13,000 per metric tonne before settling into a volatile range between $12,

Via MarketMinute · February 26, 2026

Data from Stocktwits showed that retail sentiment on SPY and QQQ diverged.

Via Stocktwits · February 26, 2026

The global commodities market reached a historic milestone this week as copper prices surged to an all-time high, shattering previous records and sending a jolt through the industrial sector. On the London Metal Exchange (LME), the "red metal" climbed to a staggering $14,527 per metric ton in late January

Via MarketMinute · February 25, 2026

The era of broad-based commodity cycles, where a rising tide of global growth or a falling dollar lifted all boats, appears to have reached a definitive end. According to the February 2026 commodity price forecast released this week by Oxford Economics, the market is entering a phase of "widening dispersion.

Via MarketMinute · February 25, 2026

Industrial metals experienced a powerful rally on February 24, 2026, as Chinese markets reopened following the nine-day Lunar New Year holiday. Investors and commodity traders returned to their desks to find a significantly altered trade landscape, catalyzed by a landmark U.S. legal decision that promises to lower the cost

Via MarketMinute · February 25, 2026